Private mortgage insurance is sometimes needed to secure a mortgage; here’s how you can eventually phase it out of your monthly payment.

Private mortgage insurance (PMI) can be expensive, and if you bought your home with a down payment of less than 20%, your mortgage lender may have required to you pay monthly PMI payments. (The same goes if you refinanced your home with less than 20% equity).

Whether you’ve recently bought your home or are considering buying a house soon, you may be wondering about private mortgage insurance; specifically, you probably want to know how much it will cost, how long you need to pay it, and how to get rid of it altogether.

If you want to buy a home but are concerned about paying PMI, consider this: in many cases, it can be beneficial to start building equity in a home now, as opposed to several years later — even if it means paying PMI for a short period. In this sense, PMI can actually be a useful way for homebuyers with no down payment or a lower down payment (less than 20%) to buy a home sooner.

The wealth you build in your home over several years could far outweigh the PMI costs. And, if you can make your mortgage payments regularly (and even some extra payments here and there), you can always refinance and remove the PMI sooner rather than later.

But, if you wait to buy a home for several years as you save for a down payment, and housing prices increase steadily, you could end up spending more on the purchase price of a home (as compared to getting a home for a lower price now and paying the PMI, which — in total — could cost you less).

The good news is: all PMI can be removed after some conditions have been met. We’ll outline three common ways below…

Lower Your Loan Principal Balance

To remove PMI, you must have at least 20% equity in the home.

Based on how much of your mortgage loan’s principal you have paid, you may request PMI cancellation.

- On the date the principal balance of your loan is first scheduled to reach 80% of the original value of the property (when you bought it), you can request PMI cancellation

- OR, on the date the principal balance of your loan actually reaches 80% of the original value of the property, you can request PMI cancellation

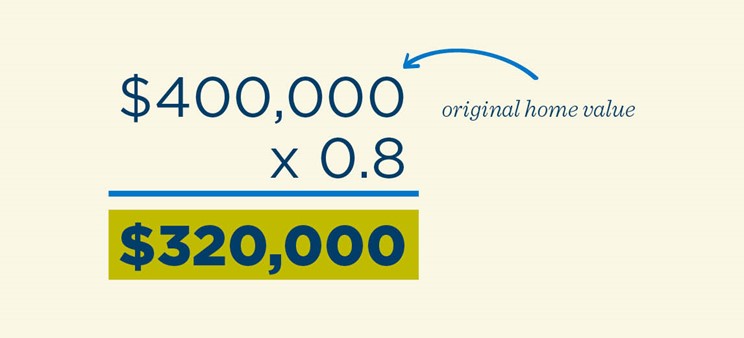

Take a look at this example: let’s say your home was originally valued at $400,000 when you bought it. This means that 80% of the original value would be $320,000.

In this case, if you have paid down the principal balance to $320,000, you could request PMI cancellation. Or, even if you haven’t quite reached $320,000 yet, you could still request cancellation on the original date that you were scheduled to reach this milestone.

Request a New Appraisal

If a new appraisal is made on your home, based on the new current value, you may request PMI cancellation — depending on the outcome of the appraisal.

- If the current appraisal shows your home’s new loan-to-value ratio is 75% or less AND the loan is between two and five years in repayment, you can request PMI cancellation.

- If the current appraisal shows your home’s new loan-to-value ratio is 80% or less AND the loan is more than five years in repayment, you can request PMI cancellation.

Keep in mind, your lender will select the appraiser and you will be responsible for the cost regardless of the new appraised value — so you want to work closely with your loan originator to be as confident as possible that your PMI cancellation will be approved before your order a new appraisal.

Check with your Lender or Loan Servicer

Lenders are often legally required to cancel PMI.

- Even if you never request for your PMI to be cancelled, if you have a specific loan type, your lender is required to cancel it on the date when your principal balance is first scheduled to reach 78% of your property’s original value.

- FHA mortgage insurance cannot be cancelled by the lender and would require borrower refinancing to remove private mortgage insurance.

Keep in mind additional conditions, such as a two-year good payment history, proof of property value (e.g., appraisal) and proof of adequate insurance (e.g., insurance binder) may apply, so these standards don’t apply to every single situation.

Still, this should give you a good idea of when your PMI will be cancelled. If you still have questions, contact your trusted loan professional for advice on your unique circumstances.